Complete tiomarkets review for first-time traders

Complete tiomarkets review for first-time traders

Blog Article

Comprehending the Fundamentals of Forex Trading: A Comprehensive Guide for Beginners

If you're brand-new to Foreign exchange trading, it can feel overwhelming at. You require to recognize vital principles like currency sets and market structure before leaping in. Desire to understand exactly how to develop a solid trading strategy that works for you?

What Is Foreign Exchange Trading?

Foreign exchange trading, short for forex trading, includes the buying and selling of currencies on a worldwide market. You engage in this dynamic market to benefit from currency changes. Unlike conventional supply markets, foreign exchange operates 24 hours a day, five days a week, enabling you to trade at any type of time that matches you.

In foreign exchange trading, you'll run into various elements that influence money worths, including financial indications, geopolitical events, and market sentiment. You'll require to examine these components to make informed decisions. The market is decentralized, meaning there's no main exchange; instead, trading happens with a network of banks, brokers, and banks.

To begin, you'll wish to select a respectable broker, established up a trading account, and create a solid trading approach. With correct education and learning and method, you can navigate the forex market and work in the direction of accomplishing your monetary objectives.

Understanding Money Pairs

In the world of foreign exchange trading, understanding money sets is vital to making educated professions. Money pairs are composed of two currencies, with the initial one being the base currency and the 2nd as the quote money.

You'll typically encounter major pairs, that include one of the most traded money, and small sets, including less frequently traded money. Comprehending these sets assists you gauge market motions and make strategic decisions.

When you trade a currency pair, you're basically betting on the toughness of one money against another. avatrade review. Knowing how these sets work will certainly give you a strong structure as you navigate the forex market and develop your trading approaches

The Forex Market Framework

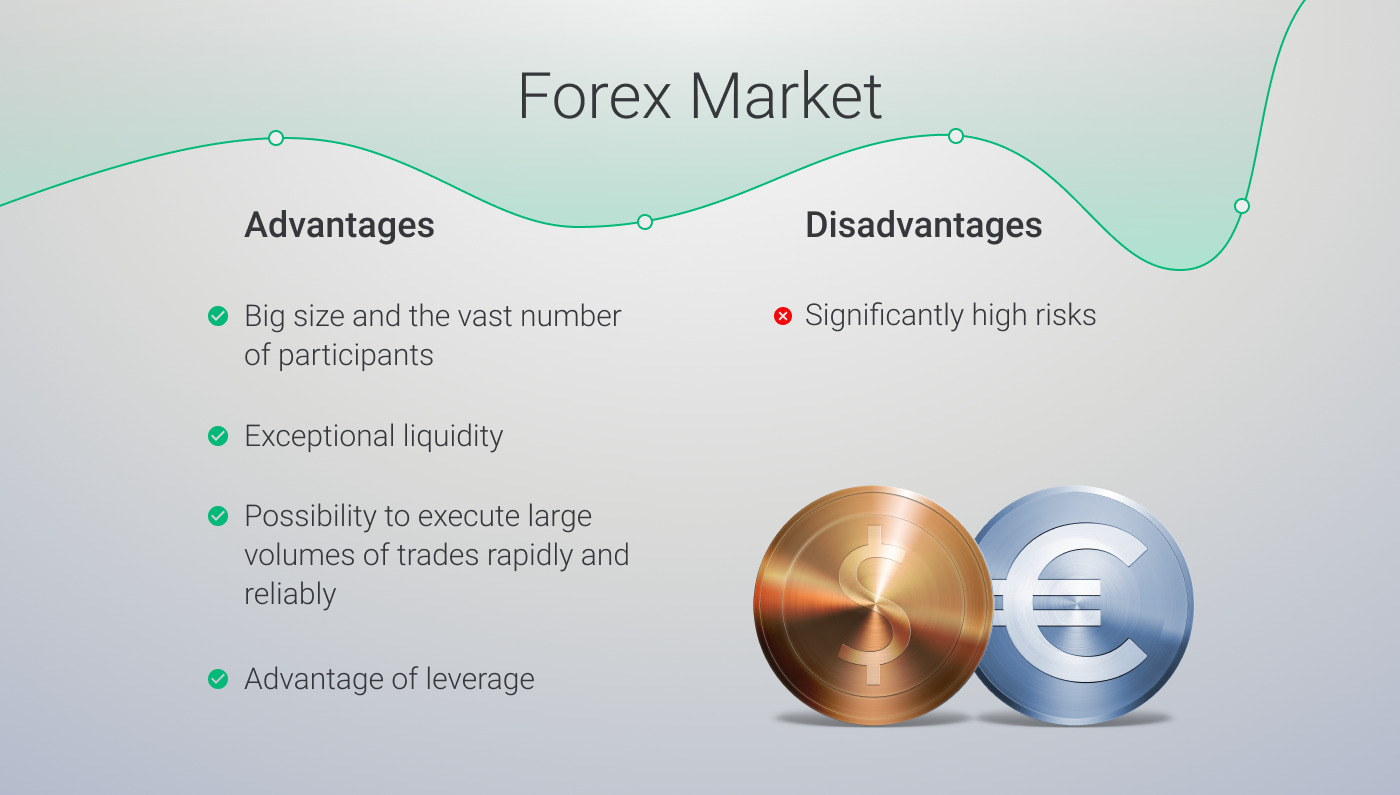

Understanding the framework of the forex market is important for any trader aiming to be successful. The foreign exchange market runs as a decentralized international industry, where currencies are traded 24/5. It's made up of different participants, including financial institutions, financial establishments, companies, and private investors like you.

At its core, the market is separated into 3 major rates: the interbank market, retail market, and broker-dealer networks. The interbank market includes huge banks trading money amongst themselves, while you, as a retail investor, generally accessibility the marketplace via brokers.

These brokers work as middlemans, offering platforms and tools for trading. It's vital to comprehend this framework, as it impacts liquidity, prices, and implementation. The more you understand exactly how these elements engage, the much better outfitted you'll be to make educated decisions and browse the intricacies of foreign exchange trading effectively.

Sorts Of Forex Analysis

Fundamental Analysis Overview

Technical Analysis Techniques

While fundamental evaluation focuses on economic indicators and political events, technological evaluation takes a different approach by taking a look at price activities and trading quantity. By mastering these devices, you can make informed trading choices based on historic cost actions rather than external elements. Technical evaluation equips you to predict future market movements properly.

Sentiment Analysis Insights

Comprehending market view is vital for effective forex trading, as it reveals the overall state of mind of investors and capitalists. You can additionally utilize belief indicators, like the Dedication of Traders (COT) report, to assess the positioning of big gamers in the market. By incorporating belief analysis with technological and fundamental analysis, you'll improve your trading strategy and make more enlightened choices.

Danger Administration Strategies

Efficient danger monitoring strategies are necessary for any kind of Foreign exchange investor aiming to secure their capital and boost long-lasting productivity. Begin by setting a risk-reward ratio for each trade, ideally intending for a proportion of 1:2 or far better. This indicates you want to run the risk of $1 to potentially obtain $2. Next, never run the risk of greater than 1-2% of your trading capital on a solitary profession; this keeps your account secure from substantial losses.

Use stop-loss orders to immediately shut trades at a predetermined loss level. This assists you adhere to your strategy and stay clear of psychological decisions. Diversifying your professions across different currency sets can additionally reduce risk, as it stops overexposure to a solitary market motion.

Finally, consistently review your trades to learn from both your successes and errors. By applying these danger management strategies, you can improve your trading useful content discipline and enhance your opportunities of lasting success in Forex trading.

Selecting a Forex Broker

When selecting a Foreign exchange broker, you need to ponder essential variables like regulative go now compliance, the trading systems they offer, and the spreads and charges involved. These elements can substantially impact your trading experience and general success. Ensure to do your homework to locate a broker that satisfies your requirements.

Regulatory Compliance Demands

Selecting the right Forex broker depends upon their regulative conformity, as this guarantees your financial investments are protected and the trading atmosphere is reasonable. When reviewing brokers, examine if they're regulated by trustworthy authorities, like the Financial Conduct Authority (FCA) or the Product Futures Trading Commission (CFTC) These bodies apply stringent guidelines to ensure brokers operate fairly and transparently.

Furthermore, seek brokers that give clear info on their licensing and registration. Openness in charges, terms, and problems is essential. Make sure they provide sufficient customer protection procedures, such as segregated accounts and adverse balance protection. By prioritizing regulatory conformity, you'll develop a solid foundation for your trading trip and decrease potential risks.

Trading Platforms Provided

A number of crucial elements come into play when assessing the trading platforms provided by Forex brokers. In addition, check if the system sustains automated trading or mobile accessibility, permitting you to trade on-the-go. A broker that supplies tutorials or customer support can make a substantial distinction, especially when you're simply beginning out in Foreign exchange trading.

Spreads and Costs

Spreads and costs play an important function in your overall Foreign exchange trading expenses, affecting your prospective earnings. Comprehending these distinctions assists you gauge your trading expenses.

Some brokers offer commission-free trading but make up with broader spreads, so review the fine print meticulously. Always contrast numerous brokers to find the ideal general expenses for your trading technique.

Developing a Trading Strategy

A solid trading plan is important for any person wanting to do well in the forex market. It functions as your roadmap, assisting news your choices and maintaining emotions in check. Begin by defining your trading goals-- whether it's to make a specific profit or gain experience. Next, establish your danger tolerance. Knowing exactly how much you agree to shed on each trade is essential for long-lasting success.

Pick a trading technique that fits your style, whether it's day trading, swing trading, or scalping. Integrate technical and basic evaluations to notify your choices. Set clear entrance and departure points for every single profession and develop a stop-loss to protect your funding.

Finally, evaluation and fine-tune your strategy frequently. Markets change, and so must your method. By sticking to your strategy, you'll construct self-control and confidence, aiding you browse the typically unstable foreign exchange landscape with greater convenience.

Often Asked Inquiries

What Is the Minimum Funding Required to Beginning Foreign Exchange Trading?

The minimal funding to begin foreign exchange trading varies by broker, but you can frequently start with just $100. It's essential to pick a broker with low minimum down payment demands to maximize your possibilities.

Exactly How Does Utilize Operate In Foreign Exchange Trading?

Utilize in foreign exchange trading allows you regulate larger positions with a smaller sized quantity of funding - CL markets review. It intensifies both potential gains and losses, so you need to manage danger very carefully to prevent considerable economic troubles

Can I Profession Forex on My Mobile Phone?

Yes, you can trade forex on your mobile tool! Many brokers use mobile applications that let you carry out professions, check the marketplace, and handle your account easily, making trading hassle-free anytime, anywhere.

What Are the Typical Mistakes Beginners Make in Forex Trading?

Typical errors you make in forex trading consist of overleveraging, disregarding risk monitoring, overlooking market evaluation, and allowing feelings dictate choices. It's vital to create a self-displined method and stay with it for constant success.

Just How Can I Track My Forex Trading Efficiency?

Report this page